How to transform payments from a cost into an opportunity

Processing payments is a necessity for every business. However, despite the number of payment and e-money firms growing by 533% in the UK between 2016 and 2021, increasing the options available in this area of finance, it continues to cause problems for some finance and technology leaders.

For instance, regardless of payments revolutionising how people handle their money, 48% of IT leaders believe that they’ve lost up to 10% of revenue because their payment processors do not offer suitable payment options. The benefits of payments therefore do not come without pitfalls.

Yet it is possible to transform payments from a “necessary evil” into an even greater positive influence upon your business. Read on to find out how.

Why do payments come at a cost?

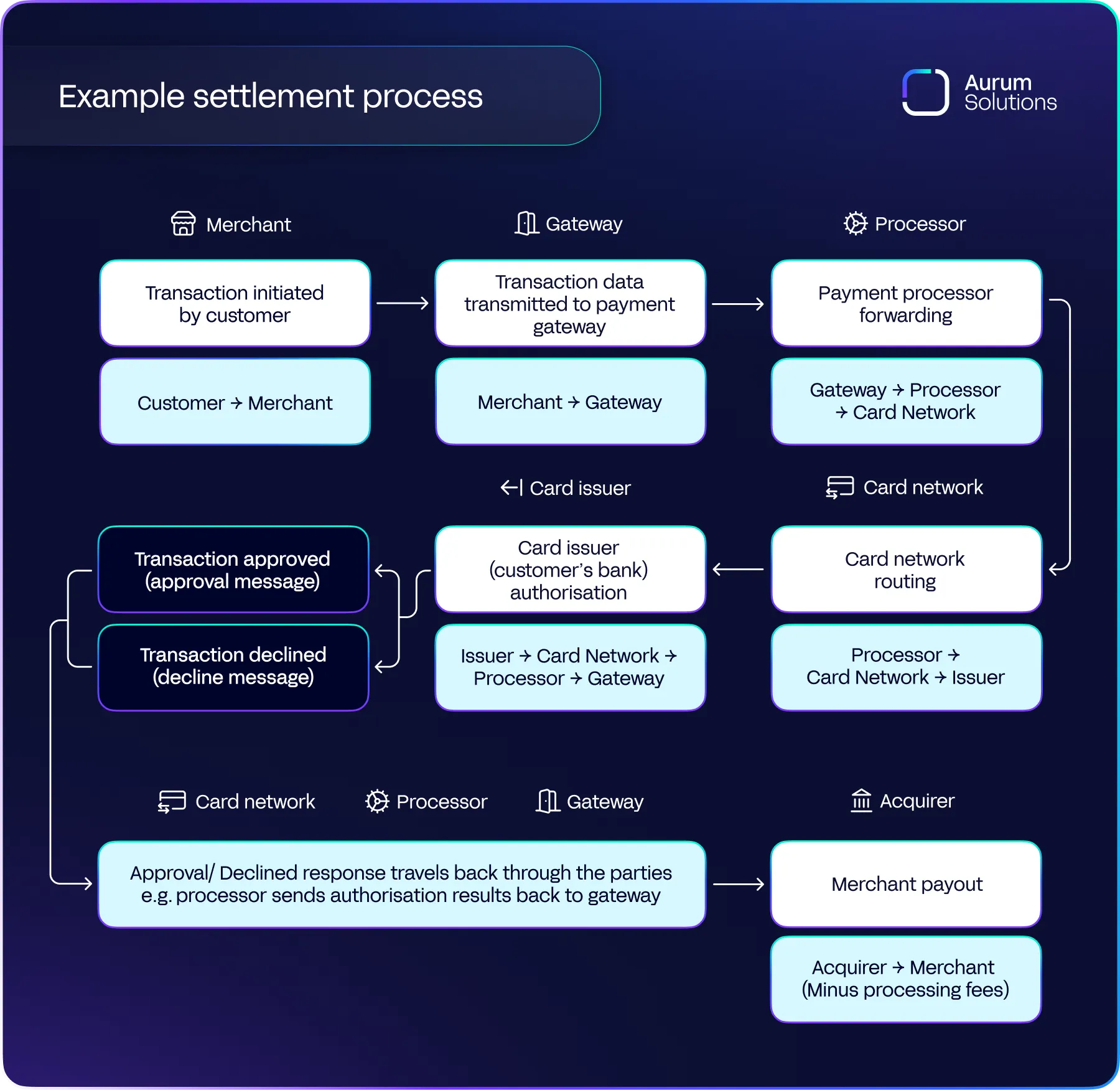

First of all, something must be acknowledged. Transforming cross-border payments, exponentially fast-tracking payments between peers, standardising and increasing the detail of payments with new ISO 20022 rules, and much more is not easy to achieve. Ultimately, although sending and receiving payments might now feel like a breeze for individuals and businesses alike, a lot of hard work is required in the background.

As a result, payment firms need to make a profit on their work to sustain their operations. Whilst this means that a cost is passed on to merchants and individuals, the evidence overwhelmingly suggests that everyone is willing to pay. In fact, the value of global mobile payments is expected to grow at a CAGR of 36.2% between 2023 and 2030. And what’s the alternative – going back to cheques which would take 5 working days to clear?

Moreover, as payments technology continues to progress, costs are coming down. For instance, nearly 50% of Citibanks corporate clients note that high costs for cross-border transactions as a pain point; however, Wise has already driven down inter-currency transactions and hope that “one day using Wise will be free”. Plus, blockchain is being touted as possessing the potential to decrease the cost of cross-border transactions by 80%.

Overall, payments costs are therefore easily justifiable even if CFOs and other financial strategists would like them to be lower. There’s the fact that they help produce modern miracles, business and customer demand for their services continues to grow, and evidence that payment firms are committed to driving their prices down through new, more efficient processes.

However, it should also be noted that costs are being driven up by payments in ways that are outside of payment firms’ control. After all, the rapid developments in payments technology have inevitably resulted in the volume of payments soaring across the globe. This is especially true given that countries with extremely high populations such as India are fervent adopters of modern payments technology.

How this can translate into costs is true in both monetary matters and that of time. This is because no matter how many transactions take place, they must all be reconciled. Failure to do so would leave payments across the globe in disrepute and risk the reputation of many financial industries. Yet when transaction volumes are pushed to extraordinarily high levels due to payments innovation, this fundamental process risks becoming an extremely lengthy and error-prone process if executed manually.

Nevertheless, digital payments are not going to go away – they generate irreplaceable advantages. What therefore remains is for other solutions to devise ways to keep up with their demands and the creation of methods that will mean their extra costs are worthwhile.

How can finance leaders offset the price of payments?

Payments wouldn’t be an industry if it didn’t offer benefits. Let alone one that has an estimated value of nearly $3 trillion. However, there is no hiding from the fact that processing costs exist, even if some payment processors are not completely transparent about their fees.

But as Primer CFO, Pierre-Edouard Jumel, rightly points out, consideration of fees – whilst important – shouldn't dominate the minds of financial professionals. Instead, progressive minds should think about how they can “use payments to drive value creation”.

The route to this is not recklessly chopping back at payment options so that only the cheapest remain, instead it requires building up your payments infrastructure. Here’s how:

- Experimenting with payment methods – there are over 1,981 PSPs in the UK alone and every customer has their own preference. Typically, the geography you are operating in and your target customers’ demographic will determine what payment methods you should adopt. However, whilst research might offer pointers as to which payment methods you should employ, the proof is in the pudding.

So, beyond research, how can you reach the right conclusion? Through trial and error, and good data. Opening yourself up to a wider variation of payment methods will inevitably over time allow you to discern which serves you and your customers best.

Reaching these conclusions though will only be possible with full data transparency. Intel on the number of transactions via certain methods, the fees of processors, and more will all be required for informed decisions to be made. That’s why Aurum acts as a central hub data, ingesting and reconciling not just transactions but also fees and additional data, to help hospitality giants, merchants of various sizes, and even gambling operators come to the right decision.

- Improving checkout experiences – payments is all about businesses successfully taking money from their clients. Whilst payment methods play a significant role in this, so too does the journey which prospective customers take before reaching the point when they make their payment.

As such, regardless of the prowess of various payment processors, they can be neutralised by a bad checkout experience. To maximise the impact of payments, businesses must therefore think not just about the method but also the overall experience. Everything from the ease of activating discount codes, to reducing the number of steps with the likes of Apple and Google Pay must be thought about.

- Boosting authorisation rates – you’ve provided them with a brilliant checkout experience, you’ve chosen the best payment methods for your customers, and they have placed their order. You might think that is all you can do. However, there remains the tricky situation of network declines.

This isn’t a small matter – increasing authorisation rates by just 0.5% can make sure that businesses don’t miss out on millions of dollars of revenue. To ensure that payments operate at their optimum, strategies and tools such as machine learning fraud solutions, accepting digital wallets, and automate card account updates should be deployed to raise authorisation rates and see payments go through successfully.

- Invest in flexible reconciliation – developing your payments infrastructure will inevitably mean working with more payment providers, increasing the variations of data you work with and the sources of your transactions. However, for this to be a success, your back-office operations must keep up, especially reconciliation.

Reconciliation, thanks to its ability to guarantee data integrity, is fundamental for various reasons, ranging from compliance to forecasting. To 100% guarantee data integrity though, reconciliation software is a non-negotiable when developing your payments strategy. After all, a successful payments strategy will be diverse and significantly increase the number of transactions you are handling. As a result, reconciliation becomes both a complex and an extremely time-consuming task if completed manually. In other words, it becomes a task that can only be completed with the assistance of automated reconciliation software.

Moreover, in the context of payments, another benefit of a reconciliation platform like Aurum that boasts over 600 APIs is that it consolidates data from all sources in one place. Data is therefore both reconciled and primed to be holistically analysed, helping payment experts evaluate their payments infrastructure.

Paying back in the long run

Payments might seem like a complex and at times fragile operation to maintain; however, finance leaders continue to engage in improving the execution of their payments strategies. Why? Because despite the cost in both time and fees, when delivered effectively with the best payments infrastructure, payments can supercharge the revenue and data insights of any company.

To provide the perfect foundation for your payments strategy, inform it with consolidated insights, and ensure unlimited growth as transaction volumes soar, book your Aurum demo today.